Contents

- I. Introduction

- II. How Does Pet Insurance Work?

- III. Types of Pet Insurance Policies

- IV. What Does Pet Insurance Cover?

- V. Factors to Consider When Choosing Pet Insurance

- VI. How to File a Pet Insurance Claim

- VII. Frequently Asked Questions (FAQs)

- 1. What is the average cost of pet insurance?

- 2. Can I get pet insurance for older pets?

- 3. Are pre-existing conditions covered?

- 4. How long do I have to wait before making a claim?

- 5. Can I use any veterinarian with pet insurance?

- 6. Are there any breed-specific exclusions?

- 7. Can I get reimbursed for routine check-ups?

- 8. Is there a waiting period for accidents?

- 9. Can I get coverage for dental procedures?

- 10. What happens if my pet has a chronic condition?

- VIII. Tips for Maximizing Pet Insurance Benefits

- IX. Best Pet Insurance Companies in 2021

I. Introduction

:quality(75))

Welcome to the world of pet insurance! As a responsible pet owner, it’s important to understand the coverage options available to you in case of emergencies. Pet insurance provides financial protection for unexpected veterinary expenses, allowing you to focus on your pet’s well-being without the added stress of hefty bills.

In this comprehensive guide, we will walk you through the ins and outs of pet insurance coverage for emergencies. We’ll explain the benefits, limitations, and factors to consider when choosing a policy. Whether you have a mischievous kitten or a senior dog, having the right insurance plan can give you peace of mind and ensure your furry friend receives the best care possible.

Throughout this article, we’ll explore various aspects of pet insurance, including the different types of coverage, common exclusions, and the claims process. We’ll also provide tips on how to find the right policy for your pet’s specific needs and budget.

By the end of this guide, you’ll have a clear understanding of how pet insurance works and be equipped with the knowledge to make an informed decision. So, let’s dive in and demystify the world of pet insurance, ensuring you and your beloved companion are prepared for any unexpected health issues that may arise.

II. How Does Pet Insurance Work?

When it comes to protecting your furry friend, pet insurance can provide peace of mind and financial security in case of unexpected accidents or illnesses. Understanding how pet insurance works is essential for pet owners who want to make informed decisions about their pet’s healthcare. In this section, we will explore the key aspects of pet insurance coverage, including coverage options, deductibles and premiums, reimbursement levels, waiting periods, and exclusions and limitations.

A. Coverage options

When selecting a pet insurance policy, it’s important to consider the coverage options available. Most pet insurance plans offer different levels of coverage, ranging from basic to comprehensive. Basic coverage typically includes accidents and injuries, while comprehensive coverage may also include illnesses, hereditary conditions, and even routine care.

It’s crucial to carefully review the coverage options and assess your pet’s specific needs. For example, if you have a young and healthy pet, a basic plan may be sufficient. However, if your pet has pre-existing conditions or you want coverage for routine care, a comprehensive plan might be more suitable.

Similar to other types of insurance, pet insurance policies often have deductibles and premiums. The deductible is the amount you need to pay out of pocket before the insurance coverage kicks in. Higher deductibles usually result in lower premium costs, while lower deductibles may lead to higher premiums.

Premiums, on the other hand, are the regular payments you make to maintain your pet insurance coverage. The cost of premiums can vary depending on factors such as your pet’s age, breed, location, and the level of coverage you choose. It’s important to consider your budget and the value of the coverage when selecting a policy.

C. Reimbursement levels

One of the key benefits of pet insurance is the reimbursement of veterinary expenses. When your pet requires medical treatment, you will need to pay the veterinary bill upfront. Afterward, you can submit a claim to your pet insurance provider to be reimbursed for eligible expenses.

Reimbursement levels refer to the percentage of the veterinary bill that the insurance company will cover. For example, if your policy offers an 80% reimbursement level and your pet’s medical bill is $1,000, you will be reimbursed $800. It’s important to review the reimbursement levels offered by different insurance providers and choose a policy that aligns with your financial needs.

D. Waiting periods

Most pet insurance policies have waiting periods, which are the specified periods of time that need to pass before certain coverage becomes effective. Waiting periods are put in place to prevent pet owners from purchasing insurance only when their pet requires immediate medical attention.

During the waiting period, any conditions or illnesses that your pet already has or develops will not be covered. Waiting periods can vary depending on the insurance provider and the specific coverage. It’s important to be aware of the waiting periods associated with your policy and plan accordingly.

E. Exclusions and limitations

While pet insurance can provide valuable coverage, it’s essential to understand the exclusions and limitations of your policy. Exclusions are specific conditions or treatments that are not covered by the insurance plan. Common exclusions may include pre-existing conditions, cosmetic procedures, and certain hereditary conditions.

Limits refer to the maximum amount the insurance company will pay for a specific condition or treatment. For example, there may be an annual limit on the coverage for a certain illness or a lifetime limit for a specific condition. It’s important to carefully review the exclusions and limitations of your policy to ensure you have a clear understanding of what is covered and what is not.

III. Types of Pet Insurance Policies

When it comes to protecting your furry friend, pet insurance can provide peace of mind and financial security. However, with so many options available, it can be overwhelming to choose the right policy for your pet’s needs. In this section, we will explore the different types of pet insurance policies to help you make an informed decision.

A. Accident-only policies

Accidents can happen at any time, and they often come with unexpected expenses. Accident-only policies are designed to cover the costs associated with accidents, such as injuries from car accidents, falls, or ingesting harmful substances. These policies typically do not cover illnesses or pre-existing conditions.

While accident-only policies provide valuable coverage for unforeseen accidents, it’s important to consider the limitations. If your pet develops an illness or requires treatment for a pre-existing condition, you may not be covered under this policy. Therefore, it’s crucial to carefully assess your pet’s overall health and potential risks before opting for an accident-only policy.

B. Illness-only policies

Illness-only policies focus on covering the costs of veterinary care for illnesses and diseases. These policies typically exclude coverage for accidents or injuries. If your pet is generally healthy and you are primarily concerned about potential illnesses, an illness-only policy may be a suitable choice.

It’s important to note that pre-existing conditions are usually not covered under illness-only policies. Therefore, if your pet has a pre-existing condition, it may be challenging to find coverage for that specific condition. However, other illnesses that arise after the policy is in effect will typically be covered, subject to the policy’s terms and conditions.

C. Comprehensive policies

Comprehensive policies offer the most extensive coverage for your pet’s healthcare needs. These policies typically cover accidents, illnesses, and sometimes even routine wellness care. With a comprehensive policy, you can have peace of mind knowing that your pet is protected in various situations.

While comprehensive policies provide comprehensive coverage, they often come with higher premiums. It’s essential to carefully assess your budget and your pet’s specific needs to determine if a comprehensive policy is the right choice for you.

D. Wellness plans

In addition to the standard coverage provided by accident-only, illness-only, or comprehensive policies, some pet insurance companies offer wellness plans as add-ons. Wellness plans are designed to cover routine preventive care, such as vaccinations, annual check-ups, dental cleanings, and flea and tick prevention.

Wellness plans can be a valuable addition to your pet’s insurance coverage, as they help offset the costs of routine care. However, it’s important to carefully review the terms and conditions of the wellness plan to ensure that the coverage aligns with your pet’s specific needs.

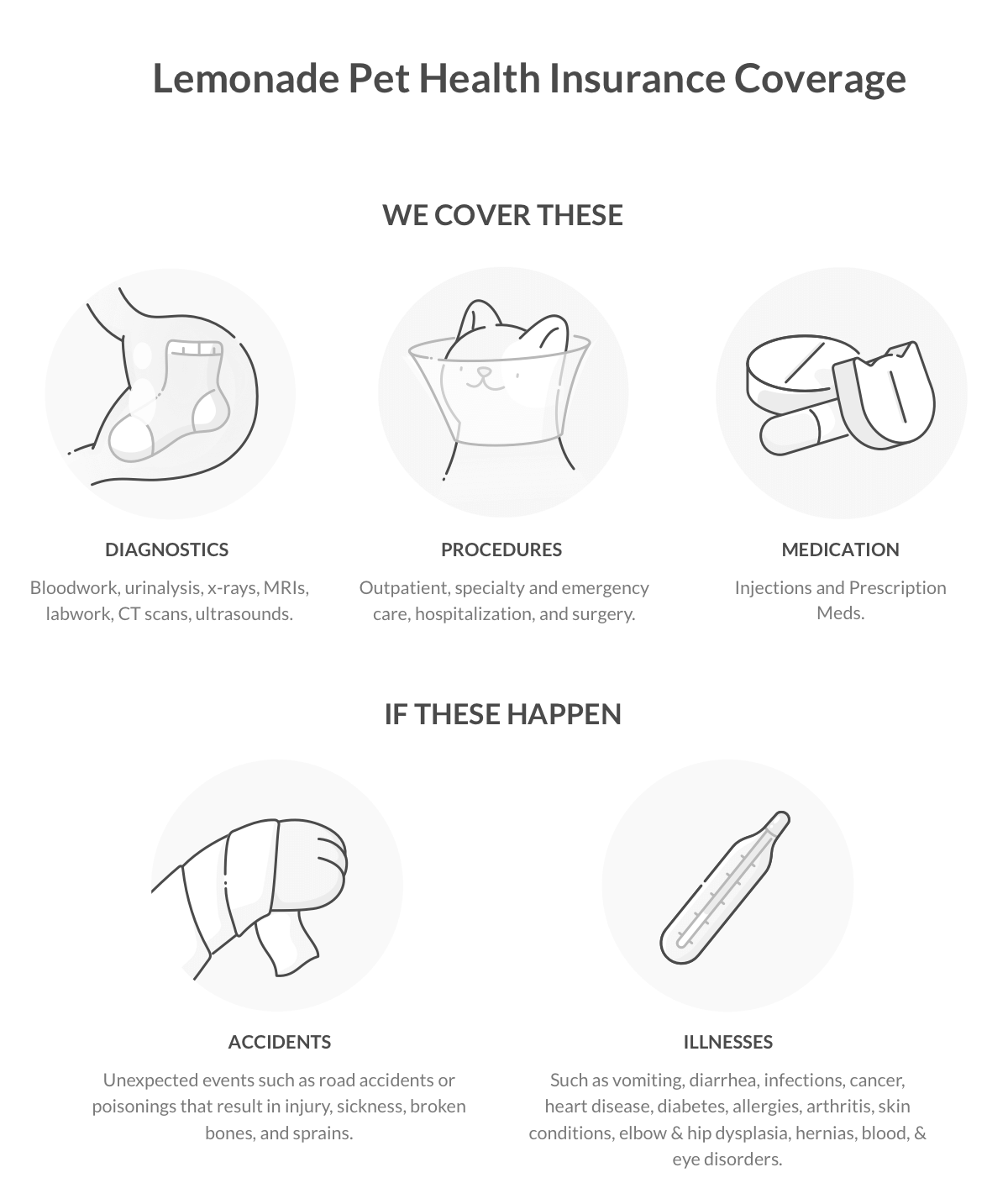

IV. What Does Pet Insurance Cover?

When it comes to protecting your beloved furry friend, pet insurance can provide the peace of mind you need. But what exactly does pet insurance cover? Let’s take a closer look at the different types of coverage you can expect from a comprehensive pet insurance policy.

A. Accidents and Injuries

Accidents can happen at any time, and pets are no exception. Whether your dog gets hit by a car or your cat falls from a tree, pet insurance can help cover the costs of treatment for accidents and injuries. This can include emergency veterinary care, surgeries, medications, and follow-up treatments.

For example, my own dog, Max, once got into a scuffle with another dog at the park and ended up with a deep bite wound. Thanks to his pet insurance, I was able to rush him to the vet and get him the immediate care he needed without worrying about the financial burden.

B. Illnesses and Diseases

Just like humans, pets can also fall ill or develop chronic diseases. Pet insurance can help cover the costs of diagnosing and treating various illnesses and diseases, including infections, allergies, cancer, diabetes, and more. This can include consultations with specialists, laboratory tests, medications, and ongoing treatments.

When my cat, Luna, was diagnosed with kidney disease, I was devastated. However, knowing that her pet insurance would help cover the costs of her regular check-ups, prescription food, and medications gave me some much-needed peace of mind.

C. Hereditary and Congenital Conditions

Some pets are born with hereditary or congenital conditions that may require lifelong management. Pet insurance can help cover the costs of treating these conditions, which can include genetic testing, surgeries, medications, and specialized care.

My friend’s dog, Bella, was born with hip dysplasia, a common hereditary condition in certain breeds. Thanks to her pet insurance, Bella was able to undergo a hip replacement surgery and receive ongoing physical therapy to improve her quality of life.

D. Diagnostic Tests and Imaging

When your pet is unwell, it’s important to get to the root of the problem. Pet insurance can cover the costs of diagnostic tests and imaging, such as blood work, x-rays, ultrasounds, and MRIs. These tests can help veterinarians accurately diagnose your pet’s condition and determine the most effective treatment plan.

When my dog, Bailey, started experiencing digestive issues, his vet recommended an ultrasound to rule out any underlying causes. Thanks to his pet insurance, I was able to proceed with the diagnostic test without hesitation.

E. Medications and Treatments

From antibiotics to pain medications, pets may require various medications and treatments throughout their lives. Pet insurance can help cover the costs of these essential treatments, ensuring that your furry friend receives the care they need without breaking the bank.

When my rabbit, Coco, developed an ear infection, her vet prescribed a course of antibiotics. Thanks to her pet insurance, I didn’t have to worry about the cost of the medication, allowing Coco to recover quickly and comfortably.

F. Surgeries and Hospitalization

Sometimes, pets may require surgeries or hospitalization for more serious conditions or injuries. Pet insurance can help cover the costs of these procedures, including pre-operative tests, anesthesia, surgical fees, hospital stays, and post-operative care.

When my guinea pig, Gizmo, developed a large tumor that needed to be removed, his pet insurance covered the entire cost of the surgery and his overnight stay at the veterinary hospital. I was relieved to know that Gizmo could receive the necessary treatment without any financial strain.

G. Alternative Therapies

In recent years, alternative therapies for pets have gained popularity. Pet insurance can also cover the costs of these treatments, which can include acupuncture, chiropractic care, physical therapy, and rehabilitation.

When my senior dog, Rocky, started experiencing joint pain, I decided to explore alternative therapies to complement his conventional treatment. Thanks to his pet insurance, I was able to afford regular acupuncture sessions, which provided him with much-needed pain relief and improved his mobility.

V. Factors to Consider When Choosing Pet Insurance

Choosing the right pet insurance can be a daunting task, especially with the wide range of options available in the market. To ensure that you make an informed decision and provide the best coverage for your furry friend, there are several factors that you should consider. These factors will help you evaluate the different insurance plans and find the one that suits your pet’s needs and your budget. In this section, we will discuss the key factors to consider when choosing pet insurance.

A. Age and breed of your pet

The age and breed of your pet play a crucial role in determining the type of insurance coverage you should opt for. Certain breeds are more prone to specific health conditions, and older pets may require more comprehensive coverage. For example, large dog breeds such as German Shepherds and Golden Retrievers are susceptible to hip dysplasia, while brachycephalic breeds like Bulldogs and Pugs are prone to respiratory issues. It is important to choose an insurance plan that covers breed-specific conditions and provides adequate coverage for your pet’s age.

B. Pre-existing conditions

Pre-existing conditions are health issues that your pet may already have before getting insurance coverage. It is crucial to understand how different insurance providers define and handle pre-existing conditions. Some insurers may exclude coverage for pre-existing conditions, while others may offer limited coverage or impose waiting periods. If your pet has a pre-existing condition, it is essential to choose an insurance plan that provides coverage for such conditions or offers a waiting period after which coverage will be available.

C. Coverage limits and caps

When selecting pet insurance, it is important to carefully review the coverage limits and caps imposed by the insurance provider. Coverage limits refer to the maximum amount the insurer will pay for a specific condition or treatment. Caps, on the other hand, refer to the maximum amount the insurer will pay over the lifetime of your pet’s policy. It is crucial to choose an insurance plan with sufficient coverage limits and caps to ensure that your pet’s medical expenses are adequately covered.

D. Waiting periods and exclusions

Most pet insurance policies have waiting periods before coverage for certain conditions or treatments becomes effective. Waiting periods can range from a few days to several weeks, depending on the insurer and the specific condition. It is important to understand the waiting periods imposed by different insurance providers and choose a plan that aligns with your pet’s immediate healthcare needs. Additionally, it is crucial to review the exclusions mentioned in the policy to ensure that the coverage meets your pet’s specific requirements.

E. Customer reviews and ratings

Before finalizing a pet insurance plan, it is advisable to research and read customer reviews and ratings. Customer reviews provide valuable insights into the experiences of other pet owners with a particular insurance provider. Look for reviews that highlight the ease of claims processing, customer service quality, and overall satisfaction. Choosing an insurance provider with positive customer reviews and high ratings will give you peace of mind knowing that you are dealing with a reputable company.

F. Cost and affordability

Cost is an important factor to consider when choosing pet insurance. Evaluate the premium costs, deductibles, and co-pays associated with different insurance plans. While it may be tempting to opt for the cheapest option, it is essential to strike a balance between cost and coverage. Consider your pet’s specific needs and budget to choose a plan that offers comprehensive coverage at an affordable price. Remember, the cheapest plan may not always provide the necessary coverage for your pet’s healthcare needs.

By considering these factors, you can make an informed decision when choosing pet insurance. Remember to carefully review the policy terms and conditions, compare different insurance providers, and select a plan that provides the best coverage for your beloved pet.

VI. How to File a Pet Insurance Claim

When it comes to pet insurance, understanding how to file a claim is essential. Whether your furry friend has had an unexpected accident or is facing a medical emergency, knowing the steps to take can help ensure that you receive the coverage you need. In this section, we will walk you through the process of filing a pet insurance claim, from gathering necessary documentation to following up on the claim.

A. Gathering necessary documentation

Before you can file a pet insurance claim, you will need to gather all the necessary documentation. This includes any medical records, invoices, and receipts related to your pet’s treatment. It’s important to keep all these documents organized and easily accessible, as they will be required when submitting the claim.

Start by contacting your veterinarian and requesting a copy of your pet’s medical records. These records should include details of the diagnosis, treatment plan, and any medications prescribed. Additionally, collect all invoices and receipts for the veterinary services provided. Make sure these documents clearly state the date, description of services, and the amount paid.

By having all the necessary documentation in one place, you can streamline the claims process and avoid any delays or complications.

B. Contacting the insurance provider

Once you have gathered all the required documentation, the next step is to contact your pet insurance provider. It’s important to reach out to them as soon as possible to initiate the claims process. Most insurance companies have a dedicated claims department or a claims submission portal on their website.

When contacting the insurance provider, be prepared to provide them with the following information:

- Your policy number

- Your pet’s name and identification details

- Date of the incident or onset of illness

- A brief description of the condition or injury

- Any relevant medical records, invoices, and receipts

Some insurance providers may require you to fill out a claim form, while others may accept the documentation via email or through their online portal. Make sure to follow their specific instructions and provide all the necessary information to avoid any delays in processing your claim.

C. Submitting the claim form

If your insurance provider requires you to fill out a claim form, make sure to complete it accurately and thoroughly. The claim form will typically ask for details such as your contact information, your pet’s information, the nature of the claim, and the amount being claimed.

Attach all the relevant documentation, including the medical records, invoices, and receipts, to the claim form. Double-check that you have included everything required before submitting the claim. Keep copies of all the documents for your records.

If the insurance provider accepts claims via email or their online portal, make sure to attach the necessary documents in the specified format. Follow their instructions carefully to ensure a smooth and efficient claims process.

D. Following up on the claim

After submitting your pet insurance claim, it’s important to follow up with the insurance provider to track the progress of your claim. This will help you stay informed and address any potential issues or delays promptly.

Check with the insurance provider to see if they offer an online portal or a customer service hotline where you can inquire about the status of your claim. Be prepared to provide them with your policy number and any other relevant information they may require.

During the follow-up process, it’s essential to maintain open communication with the insurance provider. If there are any discrepancies or additional information needed, address them promptly to avoid any further delays in processing your claim.

Remember, the time it takes to process a pet insurance claim can vary depending on the insurance provider and the complexity of the claim. Stay patient and persistent, and don’t hesitate to reach out to the insurance provider if you have any concerns or questions.

By following these steps and staying organized throughout the process, you can navigate the pet insurance claims process with ease and ensure that your furry friend receives the necessary coverage for their medical needs.

VII. Frequently Asked Questions (FAQs)

1. What is the average cost of pet insurance?

The average cost of pet insurance can vary depending on several factors, including the type of pet, their age, breed, and the coverage you choose. On average, pet insurance can cost anywhere from $20 to $50 per month for dogs and $10 to $30 per month for cats. However, it’s important to note that these are just rough estimates, and the actual cost may be higher or lower based on your specific circumstances.

2. Can I get pet insurance for older pets?

Yes, you can get pet insurance for older pets. Many pet insurance providers offer coverage for pets of all ages, including senior pets. However, it’s important to note that the cost of insurance for older pets may be higher due to the increased risk of age-related health issues. Additionally, some providers may have age restrictions or limitations on coverage for pre-existing conditions for older pets.

3. Are pre-existing conditions covered?

Most pet insurance policies do not cover pre-existing conditions. A pre-existing condition is any illness, injury, or health issue that your pet had before the start of the insurance policy. However, it’s important to review the specific terms and conditions of the policy you are considering, as some providers may offer limited coverage for certain pre-existing conditions after a waiting period.

4. How long do I have to wait before making a claim?

The waiting period before you can make a claim varies depending on the pet insurance provider and the specific policy you choose. Typically, there is a waiting period of a few days to a few weeks for accidents and illnesses. It’s important to review the policy details to understand the waiting period for each type of coverage.

5. Can I use any veterinarian with pet insurance?

Most pet insurance policies allow you to use any licensed veterinarian. However, some policies may have a network of preferred providers or offer higher reimbursement rates for visits to in-network veterinarians. It’s important to check the policy details to understand any restrictions or requirements regarding the choice of veterinarian.

6. Are there any breed-specific exclusions?

Some pet insurance policies may have breed-specific exclusions or limitations. Certain breeds may be prone to specific health issues, and insurance providers may exclude coverage for those conditions or charge higher premiums. It’s important to check the policy details and inquire about any breed-specific exclusions before purchasing pet insurance.

7. Can I get reimbursed for routine check-ups?

Some pet insurance policies offer coverage for routine check-ups and preventive care, while others may not. Routine check-ups typically include vaccinations, wellness exams, and dental cleanings. If routine care coverage is important to you, make sure to review the policy details and choose a plan that includes this coverage.

8. Is there a waiting period for accidents?

Most pet insurance policies have a waiting period for accidents, similar to the waiting period for illnesses. This waiting period ensures that the policy is not used to cover pre-existing conditions. The length of the waiting period may vary depending on the provider and policy, so it’s important to review the terms and conditions to understand the waiting period for accidents.

9. Can I get coverage for dental procedures?

Some pet insurance policies offer coverage for dental procedures, while others may have limitations or exclusions. Dental coverage may include routine cleanings, extractions, and other dental treatments. If dental coverage is important to you, make sure to review the policy details and choose a plan that includes this coverage.

10. What happens if my pet has a chronic condition?

If your pet has a chronic condition, such as diabetes or arthritis, coverage may vary depending on the pet insurance provider and policy. Some policies may offer coverage for ongoing treatment and management of chronic conditions, while others may have limitations or exclusions. It’s important to review the policy details and inquire about coverage for chronic conditions before purchasing pet insurance.

VIII. Tips for Maximizing Pet Insurance Benefits

When it comes to pet insurance, understanding the coverage for emergencies is crucial. However, it’s equally important to know how to maximize the benefits of your pet insurance policy. Here are some tips to help you make the most out of your pet insurance:

A. Regular preventive care

Prevention is always better than cure, and this holds true for your furry friends as well. Regular preventive care not only keeps your pet healthy but also helps you save on potential medical expenses. Most pet insurance policies cover preventive care, including vaccinations, flea and tick prevention, and annual wellness exams. By staying up to date with preventive care, you can catch any health issues early on and prevent them from escalating into emergencies.

Make sure to schedule regular check-ups with your veterinarian and follow their recommendations for preventive care. This not only ensures your pet’s well-being but also maximizes the benefits of your pet insurance policy.

B. Understanding policy details

One of the key factors in maximizing your pet insurance benefits is having a clear understanding of your policy details. Take the time to thoroughly read and comprehend your policy documents, including the coverage limits, deductibles, and reimbursement percentages. Familiarize yourself with any exclusions or waiting periods that may apply.

By understanding your policy, you can make informed decisions about your pet’s healthcare. You’ll know what expenses are covered and what you’ll need to pay out of pocket. This knowledge can help you plan ahead and budget accordingly.

C. Keeping accurate medical records

Keeping accurate medical records for your pet is essential when it comes to maximizing your pet insurance benefits. Maintain a file with all your pet’s medical history, including vaccinations, treatments, and any pre-existing conditions. This documentation will come in handy when filing claims with your pet insurance provider.

When visiting the veterinarian, ask for detailed invoices that clearly outline the services provided. These invoices should include diagnosis codes, treatment descriptions, and costs. This level of detail will make it easier for your pet insurance provider to process your claims and ensure you receive the maximum reimbursement.

D. Reviewing coverage annually

Pet insurance needs can change over time as your pet ages or develops new health conditions. It’s important to review your coverage annually to ensure it still meets your pet’s needs. Contact your pet insurance provider to discuss any changes in your pet’s health or lifestyle that may require adjustments to your policy.

During the annual review, consider factors such as your pet’s breed, age, and any hereditary conditions they may be prone to. Discuss with your provider if additional coverage options, such as dental care or alternative therapies, are available and suitable for your pet.

By regularly reviewing your coverage, you can make sure your pet insurance policy continues to provide the best possible benefits for your furry companion.

Remember, pet insurance is a valuable tool that can help you provide the best care for your pet without breaking the bank. By following these tips and making the most of your pet insurance policy, you can ensure your pet’s health and well-being are always a top priority.

IX. Best Pet Insurance Companies in 2021

1. Healthy Paws

When it comes to pet insurance, Healthy Paws is a top choice for many pet owners. With its comprehensive coverage and excellent customer service, it’s no wonder why people prefer this product.

Product Information

Healthy Paws offers a range of coverage options for your furry friends. Whether you have a dog or a cat, they have plans that can fit your needs. Their policies cover accidents, illnesses, and even hereditary and congenital conditions. With Healthy Paws, you can have peace of mind knowing that your pet is protected.

Why People Prefer Healthy Paws

One of the main reasons why people choose Healthy Paws is because of its high coverage limits. Unlike other pet insurance providers, Healthy Paws doesn’t impose any annual or lifetime limits on payouts. This means that if your pet requires extensive medical treatment, you won’t have to worry about reaching a cap on your coverage.

Another reason why people prefer Healthy Paws is its fast and easy claims process. You can submit your claims online, and they are usually processed within a few days. This means that you can get reimbursed for your pet’s medical expenses quickly, allowing you to focus on their health and well-being.

Features

Healthy Paws offers a range of features that make it a standout choice for pet insurance. Some of these features include:

- Comprehensive coverage for accidents, illnesses, and hereditary conditions

- No annual or lifetime limits on payouts

- Fast and easy claims process

- Direct payment to veterinarians

- 24/7 customer support

Additional Features

In addition to its standard coverage, Healthy Paws also offers some additional features that can enhance your pet insurance experience. These include:

- Wellness coverage for routine care

- Behavioral therapy coverage

- Prescription medication coverage

- Alternative therapy coverage

Warranty & Service

Healthy Paws stands behind its product with a 30-day money-back guarantee. If you’re not satisfied with your policy, you can cancel it within the first 30 days and receive a full refund.

When it comes to customer service, Healthy Paws is known for its excellent support. Their team is available 24/7 to answer any questions or concerns you may have. Whether you need help with your policy or have a claim to submit, you can count on Healthy Paws to provide prompt and friendly assistance.

Pros

| Pros | Cons |

|---|---|

| Comprehensive coverage for accidents, illnesses, and hereditary conditions | Not available in all states |

| No annual or lifetime limits on payouts | Doesn’t cover pre-existing conditions |

| Fast and easy claims process | Waiting period for certain conditions |

| Direct payment to veterinarians | |

| 24/7 customer support |

2. Petplan

Petplan is a leading provider of pet insurance, offering comprehensive coverage for emergencies and unexpected veterinary expenses. With their range of products and exceptional customer service, it’s no wonder why people prefer Petplan for their pet insurance needs.

Product Information

Petplan offers a variety of insurance plans to suit different pet owners’ needs. Their policies cover accidents, illnesses, and even hereditary conditions, ensuring that your furry friend is protected in any situation. With customizable coverage options, you can tailor the policy to fit your budget and your pet’s specific needs.

One of the standout features of Petplan is their coverage for chronic conditions. Unlike many other insurance providers, Petplan covers ongoing conditions, such as diabetes or arthritis, for the lifetime of your pet. This means that you can rest assured knowing that your pet will receive the necessary treatment and care, even if they develop a long-term health issue.

Why People Prefer Petplan

There are several reasons why people choose Petplan over other pet insurance providers. Firstly, Petplan has a reputation for excellent customer service. Their team is knowledgeable, friendly, and always ready to assist you with any questions or concerns you may have. They understand that your pet is a part of your family, and they treat you and your pet with the utmost care and respect.

Secondly, Petplan’s claims process is quick and hassle-free. They strive to make the process as easy as possible for pet owners, ensuring that you can focus on your pet’s well-being rather than dealing with paperwork and bureaucracy. With their online claims portal, you can submit claims and track their progress with just a few clicks.

Lastly, Petplan’s commitment to transparency sets them apart from other insurance providers. They provide clear and detailed information about their policies, coverage, and pricing, allowing you to make an informed decision about your pet’s insurance needs. Their website is user-friendly and provides all the necessary information upfront, so you know exactly what you’re getting.

Additional Features

In addition to their comprehensive coverage, Petplan offers several additional features that make them an attractive choice for pet owners. One of these features is their 24/7 pet helpline, where you can speak to a veterinary professional about any concerns or questions you may have regarding your pet’s health. This service provides peace of mind, knowing that expert advice is just a phone call away.

Another notable feature is Petplan’s coverage for alternative therapies. They understand that some pet owners prefer holistic or alternative treatments for their pets, and they offer coverage for these therapies. This includes acupuncture, chiropractic care, and even hydrotherapy, ensuring that your pet receives the care they need, regardless of the treatment method.

Warranty & Service

When it comes to warranty and service, Petplan goes above and beyond to ensure customer satisfaction. They offer a 30-day money-back guarantee, allowing you to cancel your policy within the first month if you’re not completely satisfied. This demonstrates their confidence in their products and their commitment to providing the best possible service to their customers.

Furthermore, Petplan offers a lifetime policy renewal guarantee. As long as you continue to renew your policy each year, they will not exclude any conditions that your pet develops over time. This provides peace of mind, knowing that your pet will always have coverage, regardless of their age or health history.

Pros and Cons

| Pros | Cons |

|---|---|

| Petplan offers comprehensive coverage for accidents, illnesses, and chronic conditions. | The premiums for Petplan can be higher compared to other pet insurance providers. |

| The claims process is quick and hassle-free, with an online claims portal for easy submission. | Some pet owners may find the coverage options overwhelming and confusing. |

| Petplan provides excellent customer service, with a knowledgeable and friendly team. | Pre-existing conditions are not covered by Petplan. |

| They offer additional features such as a 24/7 pet helpline and coverage for alternative therapies. | There may be waiting periods for certain conditions or treatments. |

| Petplan offers a 30-day money-back guarantee and a lifetime policy renewal guarantee. | Not all veterinary clinics accept Petplan insurance, so you may need to pay upfront and submit a claim for reimbursement. |

3. Embrace

When it comes to pet insurance, one product that stands out from the rest is Embrace. With its comprehensive coverage and exceptional customer service, it’s no wonder why pet owners prefer this insurance provider.

Product Information

Embrace offers a range of coverage options for pets, including accident and illness coverage, wellness rewards, and optional add-ons for prescription medications and dental care. Their policies are designed to provide pet owners with peace of mind, knowing that their furry friends are protected in case of unexpected medical expenses.

One of the standout features of Embrace is their personalized coverage plans. They understand that every pet is unique, so they offer customizable policies that can be tailored to meet the specific needs of each individual pet. This ensures that pet owners are only paying for the coverage they actually need, without any unnecessary extras.

Why People Prefer Embrace

There are several reasons why pet owners prefer Embrace over other insurance providers. Firstly, their claims process is quick and hassle-free. Pet owners can submit claims online or through their mobile app, and Embrace aims to process and reimburse claims within a few business days.

Secondly, Embrace has a reputation for excellent customer service. Their team is knowledgeable, friendly, and always ready to assist pet owners with any questions or concerns they may have. They truly care about the well-being of pets and their owners, and it shows in their commitment to providing top-notch service.

Another reason why people choose Embrace is their coverage for pre-existing conditions. While many insurance providers exclude pre-existing conditions from their policies, Embrace takes a different approach. They offer coverage for certain pre-existing conditions after a waiting period, which is a huge benefit for pet owners whose pets have ongoing medical issues.

Features

In addition to their comprehensive coverage, Embrace offers a range of features that make their policies even more appealing. One such feature is their annual deductible. Unlike some insurance providers that have per-incident deductibles, Embrace has an annual deductible, which means that once the deductible is met for the year, subsequent claims will be covered at the specified reimbursement rate.

Embrace also offers a Healthy Pet Deductible feature, which reduces the deductible by $50 each year that a pet remains healthy and doesn’t require any claims. This encourages pet owners to prioritize preventive care and maintain their pet’s overall health.

Additional Features

Embrace understands that accidents and illnesses can happen at any time, which is why they offer 24/7 access to their pet health line. Pet owners can call and speak to a veterinary professional for advice and guidance on their pet’s health concerns, providing them with peace of mind and immediate assistance when needed.

Furthermore, Embrace offers a prescription drug coverage add-on. This optional feature helps pet owners save money on their pet’s medications, making it more affordable to provide the necessary treatments and medications for their furry companions.

Warranty & Service

Embrace stands behind their products and services with a comprehensive warranty. They offer a 30-day money-back guarantee, allowing pet owners to try out their coverage and see if it meets their expectations. If for any reason a pet owner is not satisfied, they can cancel their policy within the first 30 days and receive a full refund.

Embrace also provides ongoing support and assistance to their policyholders. Their customer service team is available via phone, email, and live chat to answer any questions or concerns that pet owners may have. They strive to provide the best possible service and ensure that pet owners have a positive experience with their insurance coverage.

Pros

| Pros | Cons |

|---|---|

| Comprehensive coverage options | Limited coverage for alternative therapies |

| Customizable policies | Higher premiums compared to some competitors |

| Quick and hassle-free claims process | Waiting period for coverage of pre-existing conditions |

| Excellent customer service | |

| Coverage for pre-existing conditions after waiting period |

4. Trupanion

Trupanion is a leading provider of pet insurance that offers comprehensive coverage for emergencies. With a range of products and services tailored to meet the needs of pet owners, Trupanion has become a popular choice among pet parents. In this section, we will analyze the details of Trupanion’s products, explore why people prefer this insurance provider, discuss its key features, additional benefits, warranty and service, and weigh the pros and cons of choosing Trupanion.

Products Information

Trupanion offers a variety of insurance plans designed to provide pet owners with peace of mind and financial protection. Their policies cover a wide range of medical expenses, including accidents, illnesses, surgeries, medications, diagnostic tests, and even alternative therapies. With Trupanion, pet owners can rest assured that their furry friends will receive the best possible care without breaking the bank.

One of the standout features of Trupanion’s policies is their unlimited lifetime coverage. Unlike some other insurance providers that impose annual or lifetime caps on payouts, Trupanion ensures that pet owners can continue to claim for eligible expenses throughout their pets’ lives. This feature is particularly beneficial for pets with chronic conditions or those who require ongoing medical treatment.

Trupanion also stands out for its fast and straightforward claims process. Pet owners can submit claims online or through the Trupanion app, and the company aims to process and reimburse claims within a matter of days. This efficient claims process ensures that pet owners can focus on their pet’s well-being rather than worrying about paperwork and reimbursement delays.

Why People Prefer Trupanion

Trupanion has gained a loyal customer base for several reasons. Firstly, their commitment to providing comprehensive coverage sets them apart from other insurance providers. Pet owners appreciate the fact that Trupanion covers a wide range of medical expenses, including hereditary and congenital conditions, which are often excluded by other insurers.

Additionally, Trupanion’s dedication to transparency and simplicity resonates with pet owners. Their policies are easy to understand, and there are no hidden fees or complicated terms. This transparency helps pet owners make informed decisions about their pet’s insurance coverage and ensures that there are no surprises when it comes to claims and reimbursements.

Furthermore, Trupanion’s exceptional customer service has contributed to its popularity. Pet owners appreciate the prompt and helpful assistance provided by Trupanion’s knowledgeable team. Whether it’s answering questions about coverage, guiding pet owners through the claims process, or offering support during difficult times, Trupanion’s customer service team goes above and beyond to ensure customer satisfaction.

Features and Additional Benefits

In addition to their comprehensive coverage, Trupanion offers several features and additional benefits that make them an attractive choice for pet owners. One such feature is their direct payment option. With this feature, Trupanion can pay the veterinary hospital directly, eliminating the need for pet owners to pay out of pocket and wait for reimbursement.

Trupanion also offers a 30-day money-back guarantee, allowing pet owners to try their insurance risk-free. If a pet owner decides that Trupanion is not the right fit for them within the first 30 days, they can cancel their policy and receive a full refund.

Another notable benefit of Trupanion is their coverage for prescription medications. Many pet insurance providers exclude medications from their coverage, leaving pet owners to bear the full cost. Trupanion, on the other hand, includes prescription medications in their policies, ensuring that pets receive the necessary medications without placing a financial burden on their owners.

Warranty & Service

Trupanion offers a lifetime warranty on their policies, providing pet owners with long-term peace of mind. As long as the policy remains active, Trupanion will continue to provide coverage for eligible expenses, regardless of the pet’s age or pre-existing conditions.

Trupanion’s commitment to service excellence is evident in their customer reviews and ratings. Pet owners consistently praise Trupanion for their responsive customer service, quick claims processing, and hassle-free experience. This dedication to service has earned Trupanion a reputation as a reliable and trustworthy insurance provider in the pet industry.

Pros and Cons

| Pros | Cons |

|---|---|

| Comprehensive coverage for a wide range of medical expenses | May have higher premiums compared to some other insurance providers |

| Unlimited lifetime coverage without annual or lifetime caps | May not cover pre-existing conditions |

| Fast and straightforward claims process | May not cover certain alternative therapies |

| Transparent policies with no hidden fees | May require a waiting period before coverage begins |

| Exceptional customer service and support | |

| Direct payment option for veterinary hospitals | |

| 30-day money-back guarantee | |

| Coverage for prescription medications |

5. Nationwide

Nationwide is a leading provider of pet insurance that offers comprehensive